1QFY2019 Result Update | Automobile

July 27, 2018

Maruti Suzuki India

BUY

CMP

`9,315

Performance Update

Target Price

`10,820

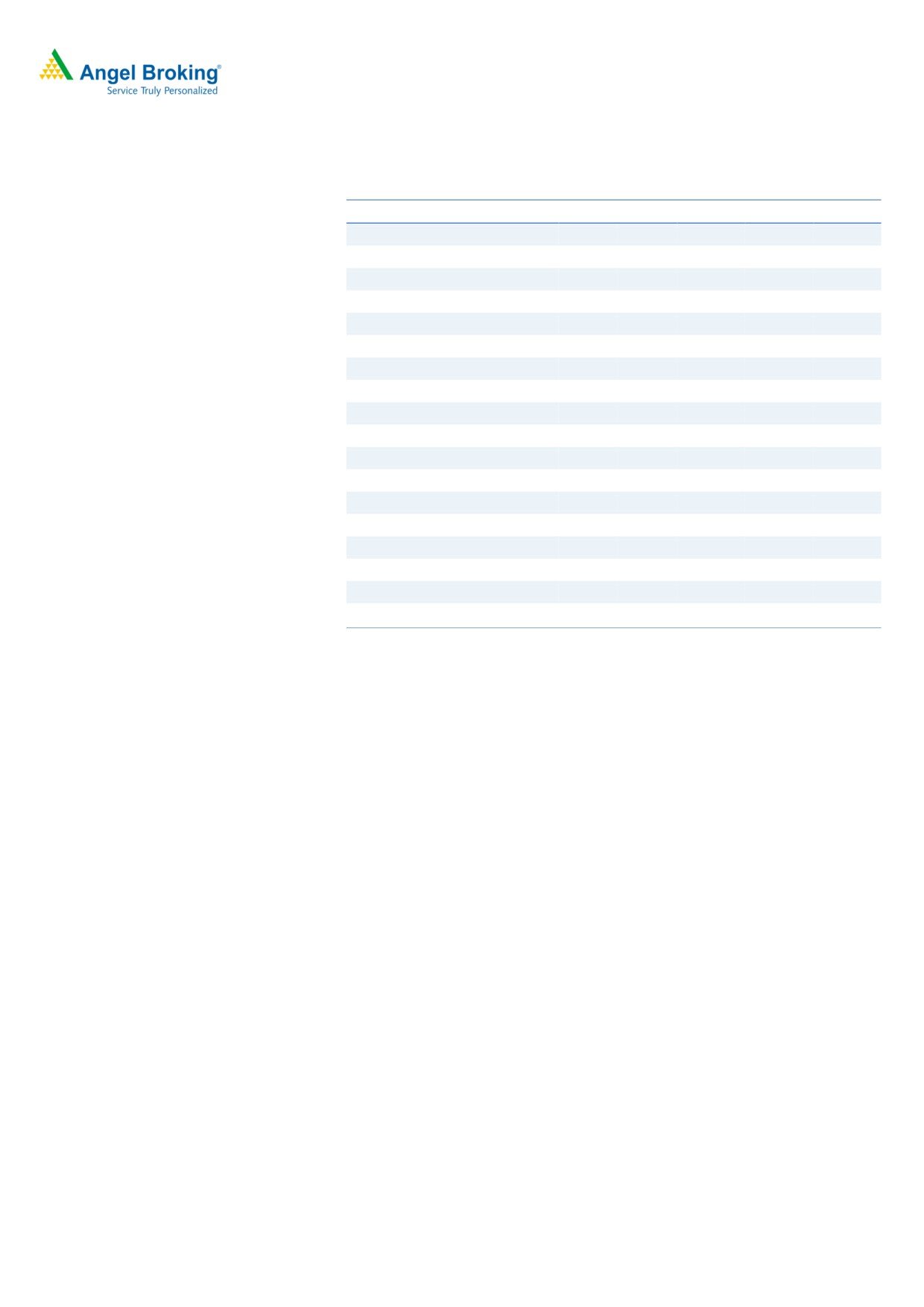

Y/E March (` cr)

1QFY19

1QFY18

% yoy

4QFY18

% qoq

Investment Period

12 months

Net sales

22,459

17,546

28.0

21,166

6.1

EBITDA

Stock Info

3,351

2,331

43.8

3,015

11.1

Sector

Automobile

EBITDA margin (%)

14.9

13.3

163bp

14.2

68bp

Market Cap (Rs cr)

2,81,505.39

Adjusted PAT

1,975

1,556

26.9

1,882

5.0

Net Debt

(35,713)

Source: Company, Angel Research

Beta

1.0

For 1QFY2019, Maruti Suzuki India (MSIL) posted strong numbers both on top-

52 Week High / Low

7,377/10,000

line and bottom-line fronts. MSIL reported

~28% yoy top-line growth to

Avg. Daily Volume

35,065

Face Value (Rs)

5

`22,459cr on back of strong volume growth (up ~24% yoy) and price hike

BSE Sensex

37,340

(up~3% yoy). The company’s operating margins improved by robust 163bps yoy.

Nifty

11,276

On the bottom-line front, MSIL reported growth of ~27% yoy to `1,975cr on the

Reuters Code

MRTI.BO

back of strong operating performance.

Bloomberg Code

MSIL.IN

Robust top-line growth: MSIL’s top-line grew by ~28% yoy to `22,459cr on the

back of ~24% yoy volume growth and ~3% average price hikes. During the

Shareholding Pattern (%)

quarter, domestic sales grew by ~26% yoy (which is ~95% of total revenue)

Promoters

56.2

and exports grew by 2% (which is ~5% of total revenue).

MF / Banks / Indian Fls

6.2

FII / NRIs / OCBs

23.7

Strong operating performance aids profitability: On the operating front, the

Indian Public / Others

13.9

company reported better margins, up 163bps yoy at 14.9%. On the bottom-line

front, MSIL reported growth of ~27% yoy to `1,975cr on the back of strong

Abs. (%)

3m 1yr

3yr

Sensex

6.5

14.2

34.2

operating performance and volume growth.

MSIL

5.0

24.0

125.0

Outlook and Valuation: We expect MSIL to report net revenue CAGR of ~16% to

~`1,08,317cr over FY2018-20E mainly due to new launches and upcoming

facelift in various models. Further, on the bottom-line front, we expect CAGR of

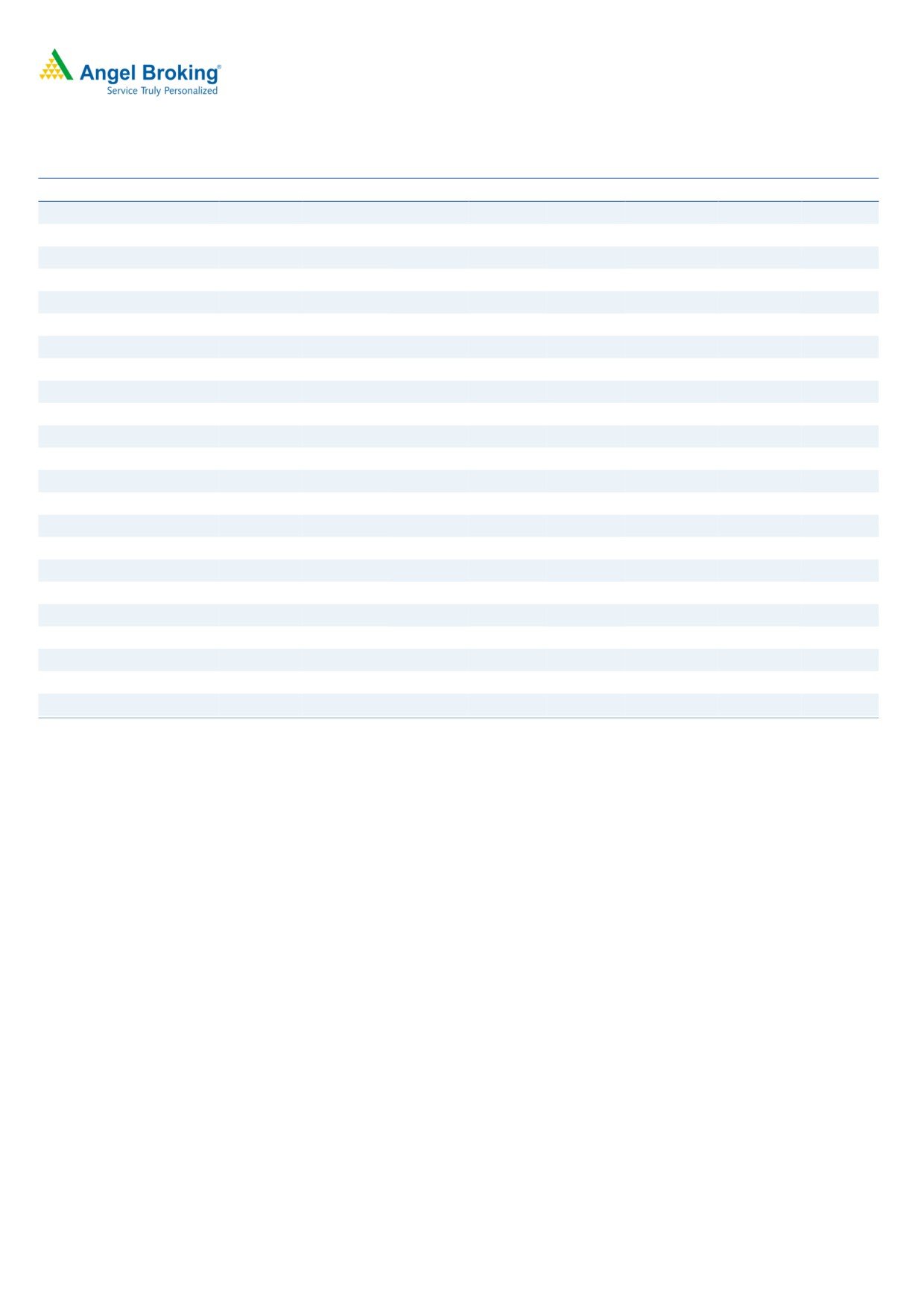

Historical share price chart

~18% to `10,892cr over the same period on the back of better margins. Thus,

we maintain our Buy recommendation on MSIL with Target Price of `10,820.

12000

10000

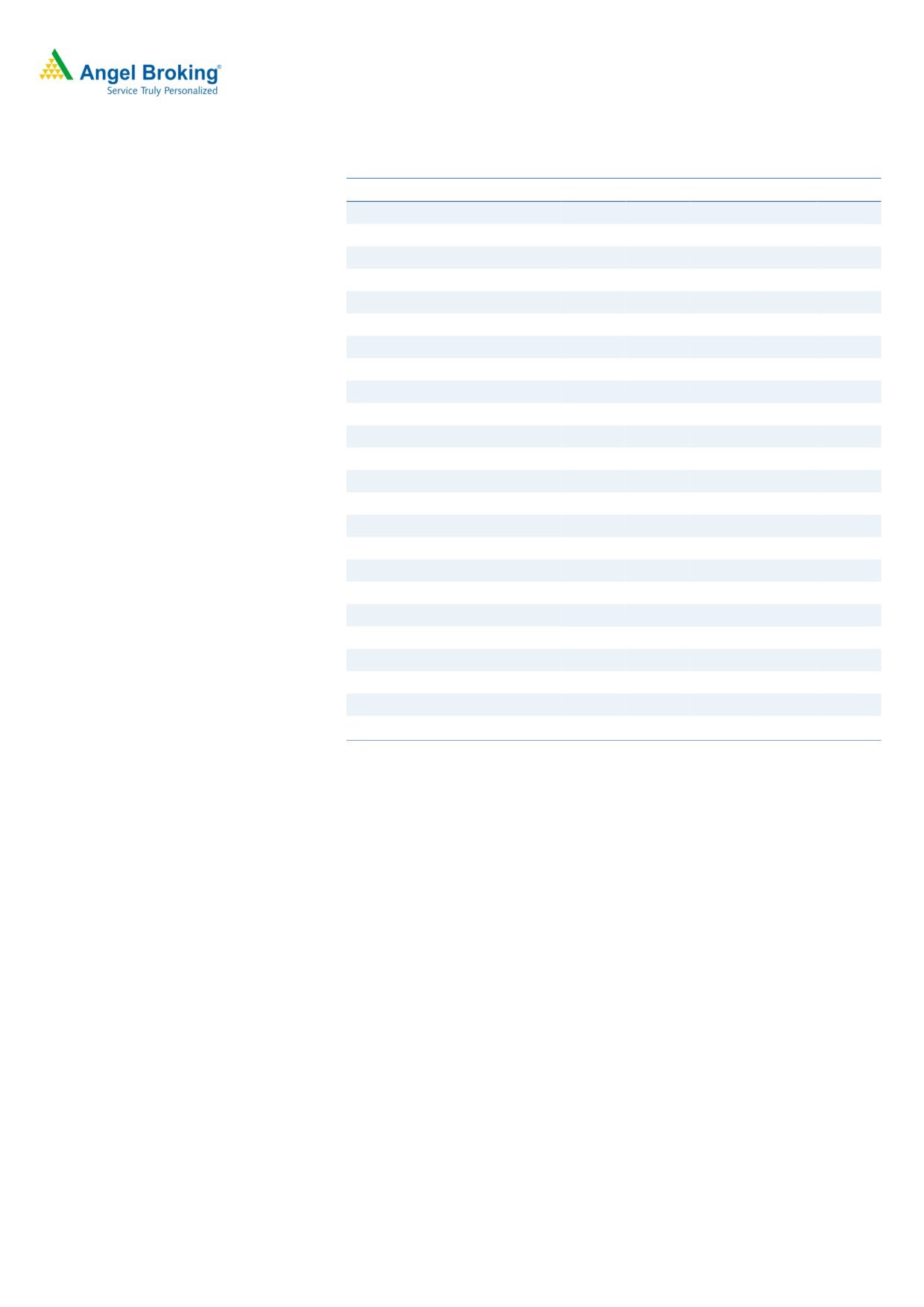

Key Financials

8000

Y/E March (` cr)

FY2017

FY2018

FY2019E

FY2020E

6000

Net sales

68,085

79,809

92,579

108,317

4000

% chg

18.2

17.2

16.0

17.0

2000

Adj. Net profit

7,511

7,881

9,414

10,892

0

% chg

36.6

4.9

19.5

15.7

EBITDA margin (%)

15.2

15.1

15.4

15.4

EPS (`)

248.7

261.0

311.7

360.7

Source: Company, Angel Research

P/E (x)

37.8

36.0

30.1

26.1

P/BV (x)

7.7

6.7

5.8

5.0

RoE (%)

20.3

18.5

19.2

19.4

RoCE (%)

20.6

21.6

22.9

24.0

Research Analyst

EV/Sales (x)

3.7

3.1

2.6

2.2

Amarjeet S Maurya

EV/EBITDA (x)

24.6

20.6

16.9

14.0

022-40003600 Ext: 6831

Source: Company, Angel Research Note

Please refer to important disclosures at the end of this report

1

Maruti Suzuki India Ltd| 1QFY2019 Result Update

Exhibit 1: 1QFY2019 Performance

Y/E March (` cr)

1QFY19

1QFY18

% yoy

4QFY18

% qoq

FY2018

FY2017

% chg

Net Sales

76

70

7.6

76

(0.3)

298

271

9.9

Staff Costs

18

17

5.1

17

5.6

69

65

5.9

(% of Sales)

23.8

24.4

22.5

23.1

24.0

Other Expenses

32

31

2.0

32

0.3

132

115

14.9

(% of Sales)

41.8

44.1

41.5

44.3

42.4

Total Expenditure

50

48

3.1

49

2.2

201

180

11.7

Operating Profit

26

22

17.5

27

(4.8)

97

91

6.4

OPM

34.4

31.5

36.0

32.6

33.6

Interest

1

4

(64.2)

3

(59.1)

15

19

(21.2)

Depreciation

7

6

5.3

7

1.0

26

20

33.5

Other Income

2

5

(48.2)

5

(55.2)

19

4

336.5

PBT (excl. Ext Items)

20

17

22.8

22.7

(10.4)

75

57

32.0

Ext (Income)/Expense

-

-

-

-

-

PBT (incl. Ext Items)

20

17

22.8

23

(10.4)

75

57

32.0

(% of Sales)

26.9

23.6

29.9

25.2

21.0

Provision for Taxation

7

6

19.5

6

6.2

24

20

15.5

(% of PBT)

33.7

34.6

28.4

31.2

35.7

Reported PAT

14

11

24.5

16

(17.0)

52

37

41.1

PATM

17.8

15.4

21.4

17.3

13.5

Minority Interest After NP

Reported PAT

14

11

24.5

16

(17.0)

52

37

41.1

Equity shares (cr)

6

6

6

6

6

FDEPS (Rs)

2.4

1.9

24.5

2.9

(17.0)

9.1

6.4

41.1

Source: Company, Angel Research

July 27, 2018

2

Maruti Suzuki India Ltd| 1QFY2019 Result Update

Outlook and Valuation

We expect MSIL to report net revenue CAGR of ~16% to ~`1,08,317cr over

FY2018-20E mainly due to new launches and upcoming facelift in various models.

Further, on the bottom-line front, we expect CAGR of ~18% to `10,892cr over the

same period on the back of better margins. Thus, we maintain our Buy

recommendation on MSIL with Target Price of `10,820.

Downside risks to our estimates

Strong launches and facelift of existing model from competitors like Hyundai

Motors, M&M, Ford, etc. can grab the market share from MSIL

Slowdown of economy can impact the overall buying sentiment of automobile

segment

Company Background

Maruti Suzuki, a subsidiary of Suzuki Motor Corporation of Japan, is India's largest

passenger car company, accounting for over 45% of the domestic car market. The

company offers 14 brands spanning across car, UV and MPV segments. WagonR,

Swift, DZire, Baleno, Brezza and Ciaz are the most popular models and dominate

the market in their respective segments. It has three manufacturing facilities in

Gurgaon and Manesar with installed capacity of c.1.55mn units. It has the most

extensive distribution network among all PV companies in India.

July 27, 2018

3

Maruti Suzuki India Ltd| 1QFY2019 Result Update

Profit & Loss Statement

Y/E March (` cr)

FY2016

FY2017

FY2018

FY2019E

FY2020E

Net Sales

57,589

68,085

79,809

92,579

108,317

% chg

13.4

18.2

17.2

16.0

17.0

Total Expenditure

48,700

57,727

67,746

78,322

91,636

Raw Material

38,706

46,742

54,986

64,805

76,039

Personnel

2,000

2,360

2,863

3,333

3,899

Others Expenses

7,994

8,624

9,897

10,184

11,698

EBITDA

8,889

10,358

12,063

14,257

16,681

% chg

16.5

16.5

18.2

17.0

(% of Net Sales)

15.4

15.2

15.1

15.4

15.4

Depreciation& Amortisation

2,822

2,604

2,760

2,917

3,100

EBIT

6,067

7,754

9,304

11,340

13,581

% chg

27.8

20.0

21.9

19.8

(% of Net Sales)

10.5

11.4

11.7

12.2

12.5

Interest & other Charges

82

89

346

92

95

Other Income

1,600

2,462

2,209

2,200

2,300

(% of PBT)

21.1

24.3

19.8

16.4

14.6

Recurring PBT

7,585

10,127

11,167

13,448

15,786

% chg

33.5

10.3

20.4

17.4

Tax

2,088

2,616

3,286

4,034

4,894

(% of PBT)

27.5

25.8

29.4

30.0

31.0

PAT (reported)

5,497

7,511

7,881

9,414

10,892

Extraordinary Items

-

-

-

-

-

ADJ. PAT

5,497

7,511

7,881

9,414

10,892

% chg

36.6

4.9

19.5

15.7

(% of Net Sales)

9.5

11.0

9.9

10.2

10.1

Basic EPS (`)

182.0

248.7

261.0

311.7

360.7

Fully Diluted EPS (`)

182.0

248.7

261.0

311.7

360.7

% chg

44.4

36.6

4.9

19.5

15.7

July 27, 2018

4

Maruti Suzuki India Ltd| 1QFY2019 Result Update

Balance Sheet

Y/E March (` cr)

FY2016

FY2017

FY2018

FY2019E FY2020E

SOURCES OF FUNDS

Equity Share Capital

151

151

151

151

151

Reserves& Surplus

30,465

36,924

42,389

48,782

56,050

Shareholders Funds

30,616

37,075

42,540

48,933

56,201

Total Loans

231

484

484

484

484

Deferred Tax Liability

861

1,110

1,110

1,110

1,110

Total Liabilities

31,722

38,684

44,148

50,542

57,810

APPLICATION OF FUNDS

Gross Block

15,343

18,680

22,086

24,586

27,086

Less: Acc. Depreciation

2,813

5,370

8,129

11,046

14,147

Net Block

12,530

13,311

13,957

13,540

12,940

Capital Work-in-Progress

1,007

1,252

1,252

1,252

1,252

Investments

20,676

29,151

36,123

43,123

50,123

Current Assets

8,513

8,247

7,148

9,323

13,058

Inventories

3,133

3,264

3,160

3,805

4,451

Sundry Debtors

1,323

1,203

1,465

2,029

2,968

Cash

51

24

74

249

765

Loans & Advances

2,303

2,129

439

463

1,625

Other Assets

1,703

1,628

2,010

2,777

3,250

Current liabilities

11,636

13,881

14,936

17,300

20,167

Net Current Assets

(3,122)

(5,634)

(7,788)

(7,977)

(7,109)

Deferred Tax Asset

632

604

604

604

604

Mis. Exp. not written off

-

-

-

-

-

Total Assets

31,722

38,684

44,148

50,542

57,810

July 27, 2018

5

Maruti Suzuki India Ltd| 1QFY2019 Result Update

Consolidated Cashflow Statement

Y/E March (` cr)

FY2016

FY2017

FY2018E FY2019E FY2020E

Profit before tax

7585

10127

11167

13448

15786

Depreciation

2822

2604

2760

2917

3100

Change in Working Capital

1460

2192

2204

365

(353)

Interest / Dividend (Net)

(70)

52

346

92

95

Direct taxes paid

(1912)

(2323)

(3286)

(4034)

(4894)

Others

(1402)

(2370)

0

0

0

Cash Flow from Operations

8483

10282

13191

12788

13735

(Inc.)/ Dec. in Fixed Assets

(2456)

(3236)

(3406)

(2500)

(2500)

(Inc.)/ Dec. in Investments

(4774)

(5937)

(6973)

(7000)

(7000)

Cash Flow from Investing

(7230)

(9173)

(10379)

(9500)

(9500)

Issue of Equity

0

0

0

0

0

Inc./(Dec.) in loans

(235)

253

0

0

0

Dividend Paid (Incl. Tax)

(755)

(1057)

(2416)

(3020)

(3624)

Interest / Dividend (Net)

(239)

(331)

(346)

(92)

(95)

Cash Flow from Financing

(1229)

(1136)

(2762)

(3112)

(3719)

Inc./(Dec.) in Cash

23

(27)

50

176

516

Opening Cash balances

28

51

24

74

249

Closing Cash balances

51

24

74

249

765

July 27, 2018

6

Maruti Suzuki India Ltd| 1QFY2019 Result Update

Key Ratio

Y/E March

FY2016

FY2017

FY2018

FY2019E FY2020E

Valuation Ratio (x)

P/E (on FDEPS)

51.6

37.8

36.0

30.1

26.1

P/CEPS

34.1

28.1

26.7

23.0

20.3

P/BV

9.3

7.7

6.7

5.8

5.0

Dividend yield (%)

0.4

0.8

0.9

1.1

1.3

EV/Sales

4.6

3.7

3.1

2.6

2.2

EV/EBITDA

29.6

24.6

20.6

16.9

14.0

EV / Total Assets

8.3

6.6

5.6

4.8

4.0

Per Share Data (`)

EPS (Basic)

182.0

248.7

261.0

311.7

360.7

EPS (fully diluted)

182.0

248.7

261.0

311.7

360.7

Cash EPS

275.5

334.9

352.3

408.3

463.3

DPS

35.0

75.0

80.0

100.0

120.0

Book Value

1,013.8

1,227.7

1,408.6

1,620.3

1,861.0

Returns (%)

ROCE

19.7

20.6

21.6

22.9

24.0

Angel ROIC (Pre-tax)

59.9

92.5

136.3

187.6

234.3

ROE

18.0

20.3

18.5

19.2

19.4

Turnover ratios (x)

Asset Turnover (Gross Block)

3.8

3.6

3.6

3.8

4.0

Inventory / Sales (days)

20

17

14

15

15

Receivables (days)

8

6

7

8

10

Payables (days)

51

49

45

45

45

Working capital cycle (ex-cash) (days)

(23)

(25)

(24)

(22)

(20)

Source: Company, Angel Research

July 27, 2018

7

Maruti Suzuki India Ltd| 1QFY2019 Result Update

Research Team Tel: 022 - 39357800

DISCLAIMER

Angel Broking Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited, Bombay

Stock Exchange Limited and Metropolitan Stock Exchange Limited. It is also registered as a Depository Participant with CDSL and

Portfolio Manager and Investment Adviser with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking

Limited is a registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration

number INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for

accessing /dealing in securities Market. Angel or its associates/analyst has not received any compensation / managed or co-managed

public offering of securities of the company covered by Analyst during the past twelve months.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals. Investors are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate the

contrary view, if any

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Limited has not independently verified all the information contained within this document. Accordingly, we cannot testify,

nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document. While

Angel Broking Limited endeavors to update on a reasonable basis the information discussed in this material, there may be regulatory,

compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or in

connection with the use of this information.

Disclosure of Interest Statement

Maruti Suzuki India

1. Financial interest of research analyst or Angel or his Associate or his relative

No

2. Ownership of 1% or more of the stock by research analyst or Angel or associates or relatives

No

3. Served as an officer, director or employee of the company covered under Research

No

4. Broking relationship with company covered under Research

No

Ratings (Returns):

Buy (> 15%)

Accumulate (5% to 15%)

Neutral (-5 to 5%)

Reduce (-5% to -15%)

Sell (< -15%)

July 27, 2018

8